Equity holds a pivotal role in assessing a company’s value and financial stability, making it a crucial concept for both investors and entrepreneurs. In this comprehensive guide, we will delve into the concept of equity in business, explore its significance, and provide insights into its calculation.

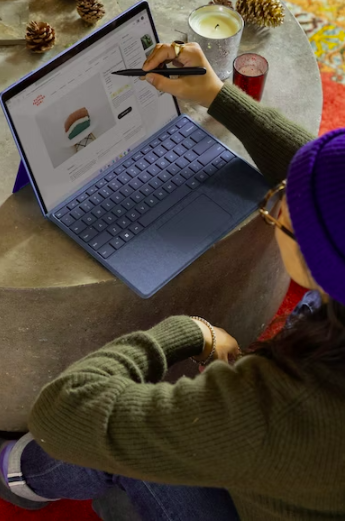

Business Accountants: Understanding Equity in Business: Definition, Calculation, and Importance